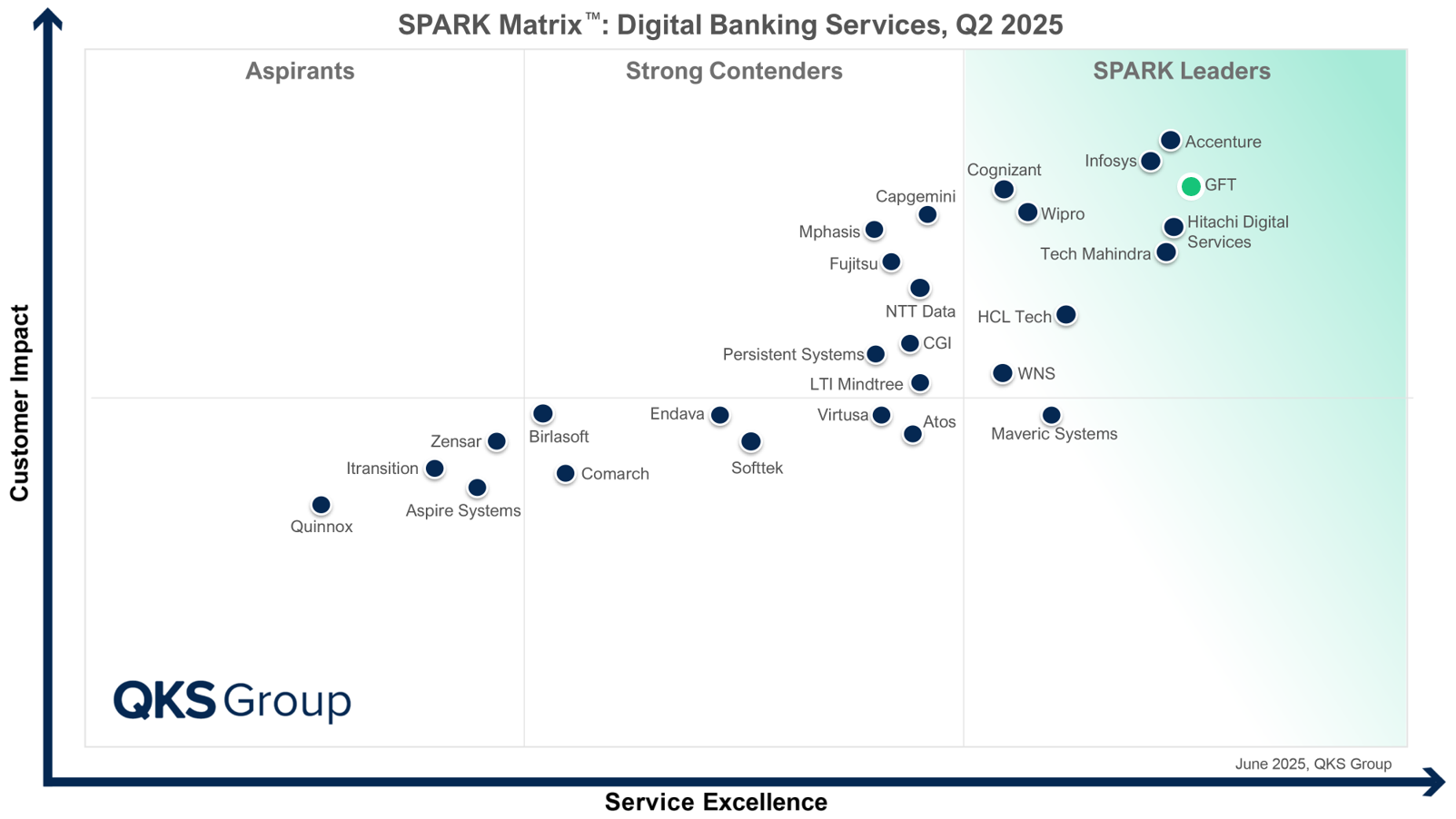

GFT outperforms the market in provision of digital banking services

Research and Report

A strenghtened Technology Leader

Key differentiators of GFT

GFT is accelerating the reinvention of digital banking through its unique blend of engineering depth, AI-first delivery, and cloud-native modernization frameworks. With proprietary accelerators such as Wynxx, BankLiteX, BankStart, and the Digital Bank Launcher, GFT empowers banks to move beyond incremental upgrades and embrace full-stack transformation, from core modernization to intelligent customer engagement. By combining AI-powered decisioning, real-time core banking integration, and agile delivery models, GFT helps clients unlock new revenue streams, elevate customer experience, and future-proof their digital ecosystems. This engineering-led approach, grounded in deep financial services insight, positions GFT not just as an IT partner, but as a transformation catalyst.

The rise of neobanks

Delve into the future of finance in this Expert Edge fireside chat video from Quadrant Knowledge Solutions featuring GFT banking expert Antonio Camacho Hubner.