The digital bank of tomorrow. Here today.

Accelerating cloud-based digital banking.

A simple and effective solution to your challenges

Flexibility and collaboration by design

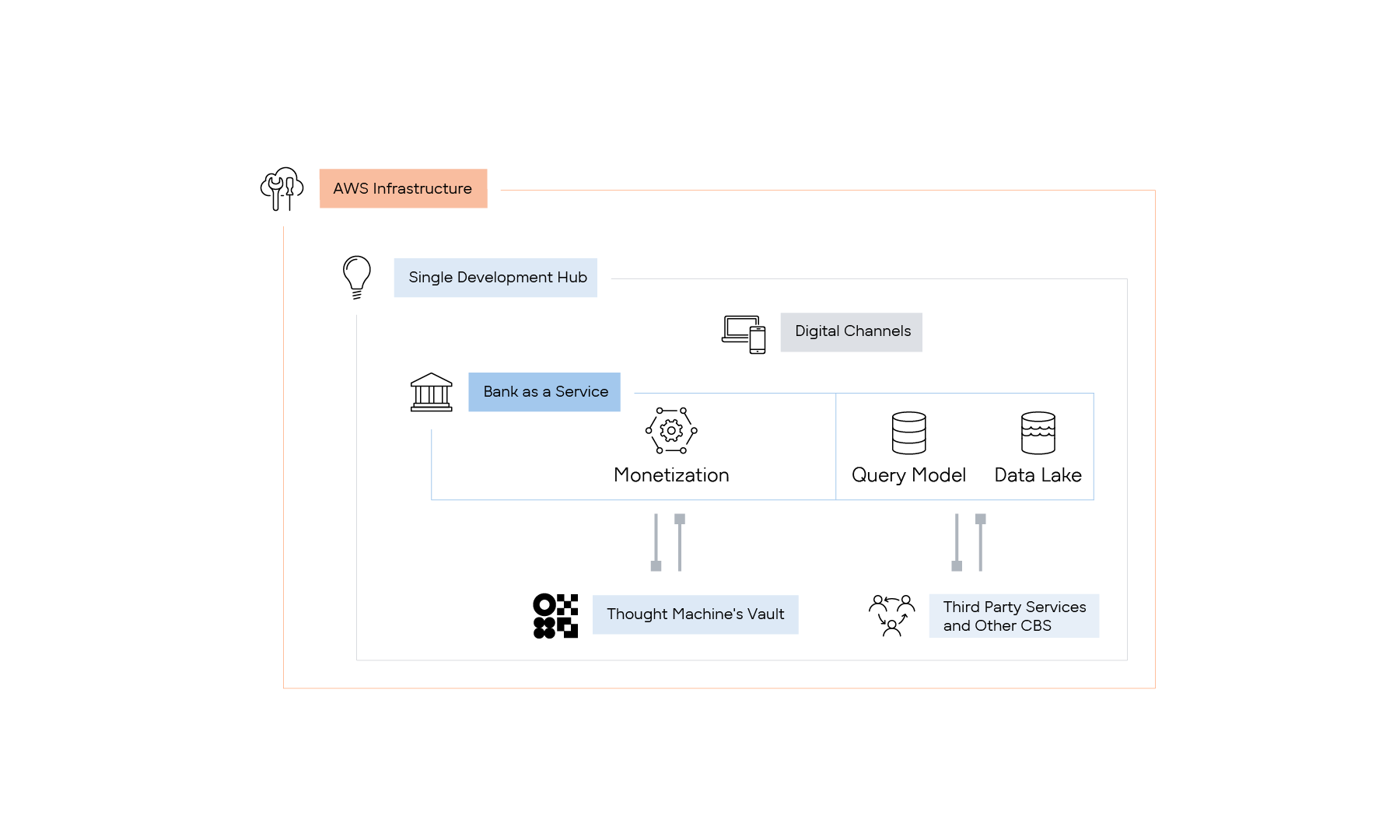

Designed with a building block architecture and pluggable components, based on GFT’s Digital Bank Launcher accelerator, and leveraging AWS cloud-native services, BankLiteX provides you with a basis to jumpstart your digital bank.

1

gatedDownload.step1

2

gatedDownload.step2

3

gatedDownload.step3