How AI Is Reshaping the Insurance Value Chain

1. Why Now? The Data Behind the Shift

Over the past two years, market data from leading analysts has made one thing clear: AI is at present a competitive differentiator.

-

Forrester Research predicts that by 2025, fewer than 5 % of insurers will achieve measurable revenue growth directly attributable to AI. The barrier isn’t technology, it’s the inability to move beyond pilots and scale initiatives.

-

McKinsey & Company highlights that AI transformation in underwriting and claims delivers double-digit operational gains, including up to 40 % lower onboarding costs and 3–5 % higher claims accuracy, which ultimately strengthens insurers’ loss ratios over time.

-

Academic research by Eling & Nuessle (University of St. Gallen) argues that AI is pushing the insurance model from loss compensation toward loss prediction and prevention, enabling insurers to better anticipate and manage risk before it occurs.

These insights all point in the same direction: AI maturity has reached a tipping point. But value creation depends on knowing where to start, what to prioritize and how to scale effectively.

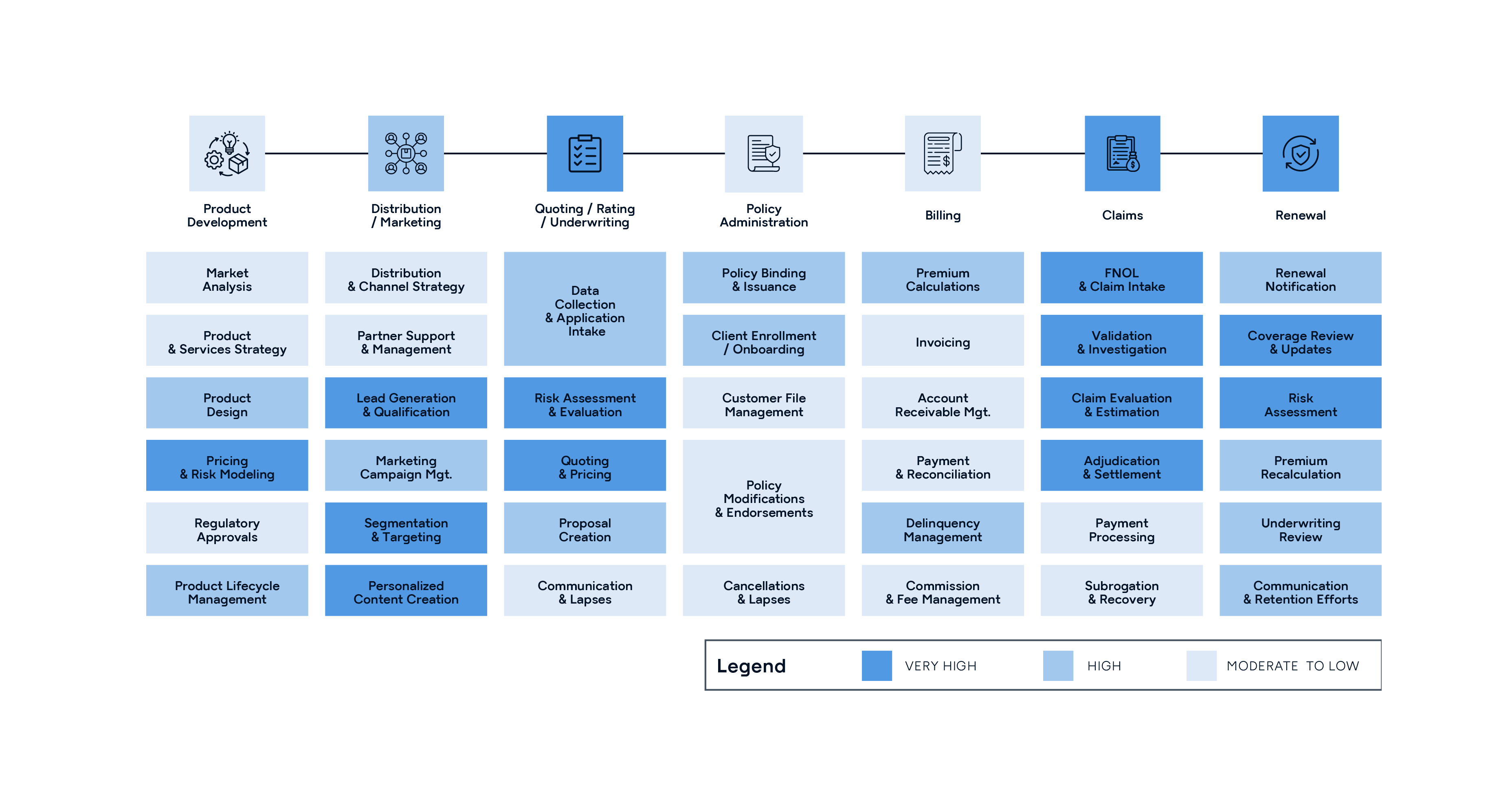

2. The Insurance Value Chain Through the Lens of AI

To translate this AI ambition into measurable performance, insurers must look across their entire value chain, identifying where AI can deliver tangible outcomes today and where groundwork is still needed.

At GFT, we see the end-to-end insurance value chain as being divided into seven key stages:

Each stage offers potential for AI adoption, but the level of impact and readiness varies significantly:

-

Product Development – AI accelerates product innovation by analyzing customer behavior, claims data, and market trends to identify coverage gaps, simulate pricing models, and shorten time-to-market for new offerings.

-

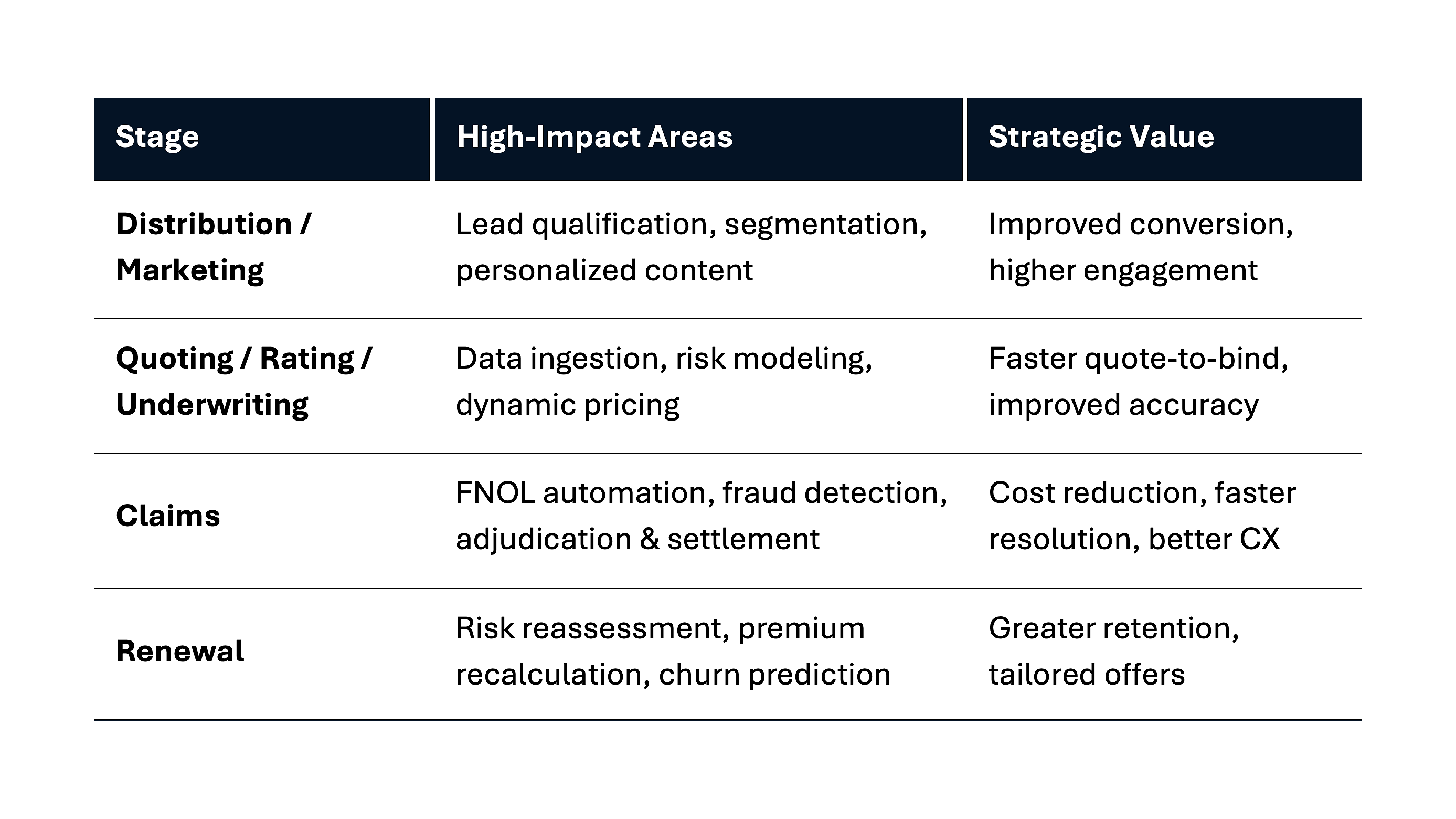

Distribution / Marketing – Generative AI personalizes campaigns, automates content creation, and improves lead qualification through better segmentation and predictive targeting.

-

Quoting / Rating / Underwriting – AI enhances risk assessment, enables dynamic pricing, and streamlines policy decisions with real-time data and predictive analytics.

-

Policy Administration – Intelligent automation supports data validation, policy updates, and documentation management, reducing manual workload and errors.

-

Billing – AI assists with payment reconciliation, anomaly detection, and delinquency prediction to improve collection efficiency and cash flow visibility.

-

Claims – From FNOL to settlement, AI automates triage, detects fraud, estimates losses, and accelerates resolution while improving customer experience.

-

Renewal – Predictive analytics identify churn risks, optimize premium recalculation, and recommend tailored offers to retain valuable customers.

While every stage can benefit from AI, not all deliver equal business value today.

Understanding where AI is ready to perform and aligning those opportunities with your organization’s strategic goals and data maturity, is definitively the foundation for success.

3. Reading the Heatmap — Where AI Delivers the Greatest Impact

As presented, we developed the AI Impact Heatmap, a framework that maps the intersection of AI maturity and business value across the insurance lifecycle. To help insurers visualize these differences, our analysis identifies four “very high-impact” zones where AI is already transforming operational performance:

The remaining functions (Product Development, Policy Administration and Billing) are emerging opportunity zones. As data quality, integration, and automation capabilities improve, these areas will become the next frontier for AI-driven optimization.

Ready to Scale AI Across Your Value Chain?

Success always starts with clarity.

GFT helps you identify where AI creates the most value, how to scale it responsibly, and how to turn innovation into measurable performance.