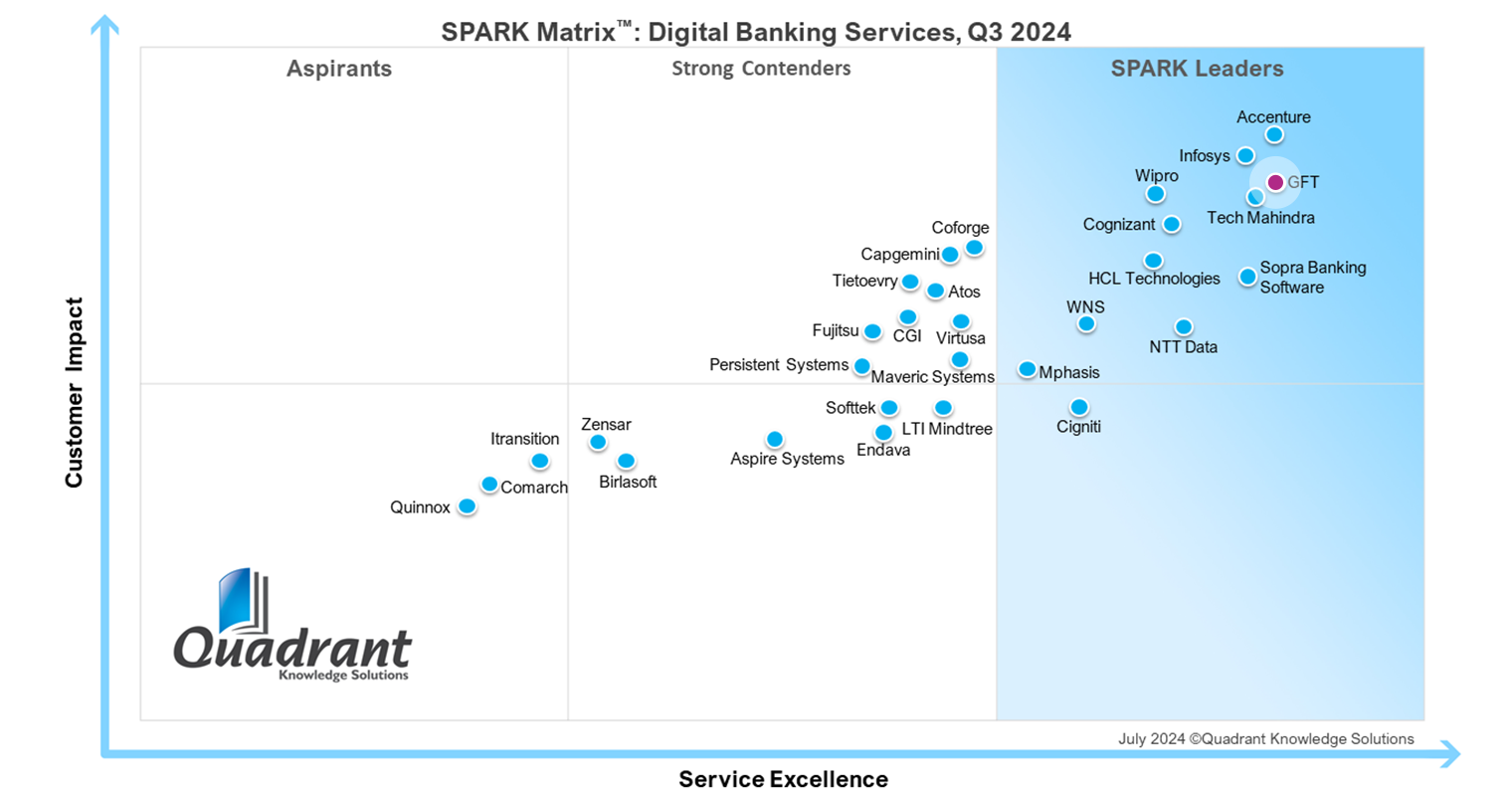

Consolidated leader in digital banking services

GFT strengthens its leadership position in the 2024 edition of Quadrant’s SPARK Matrix Digital Banking Services

Research and Report

A consolidated Technology Leader

Key differentiators of GFT

“

GFT stands out in the global Digital Banking Services market owing to its differentiated offerings, such as a suite of assets and accelerators tailored for digital banking, particularly across platforms like Thought Machine and Mambu […] With its comprehensive functional capabilities, strong customer value proposition, and compelling ratings across customer impact and service excellence parameters, GFT has been recognized as a leader in the 2024 SPARK Matrix™: Digital Banking Services.

VVVD Akhilesh

Analyst, Quadrant Knowledge Solutions

1

gatedDownload.step1

2

gatedDownload.step2

3

gatedDownload.step3

The rise of neobanks

Delve into the future of finance in this Expert Edge fireside chat video from Quadrant Knowledge Solutions featuring GFT banking expert Antonio Camacho Hubner.